Introduction to the History of Currency

The Dawn of Trade and Exchange

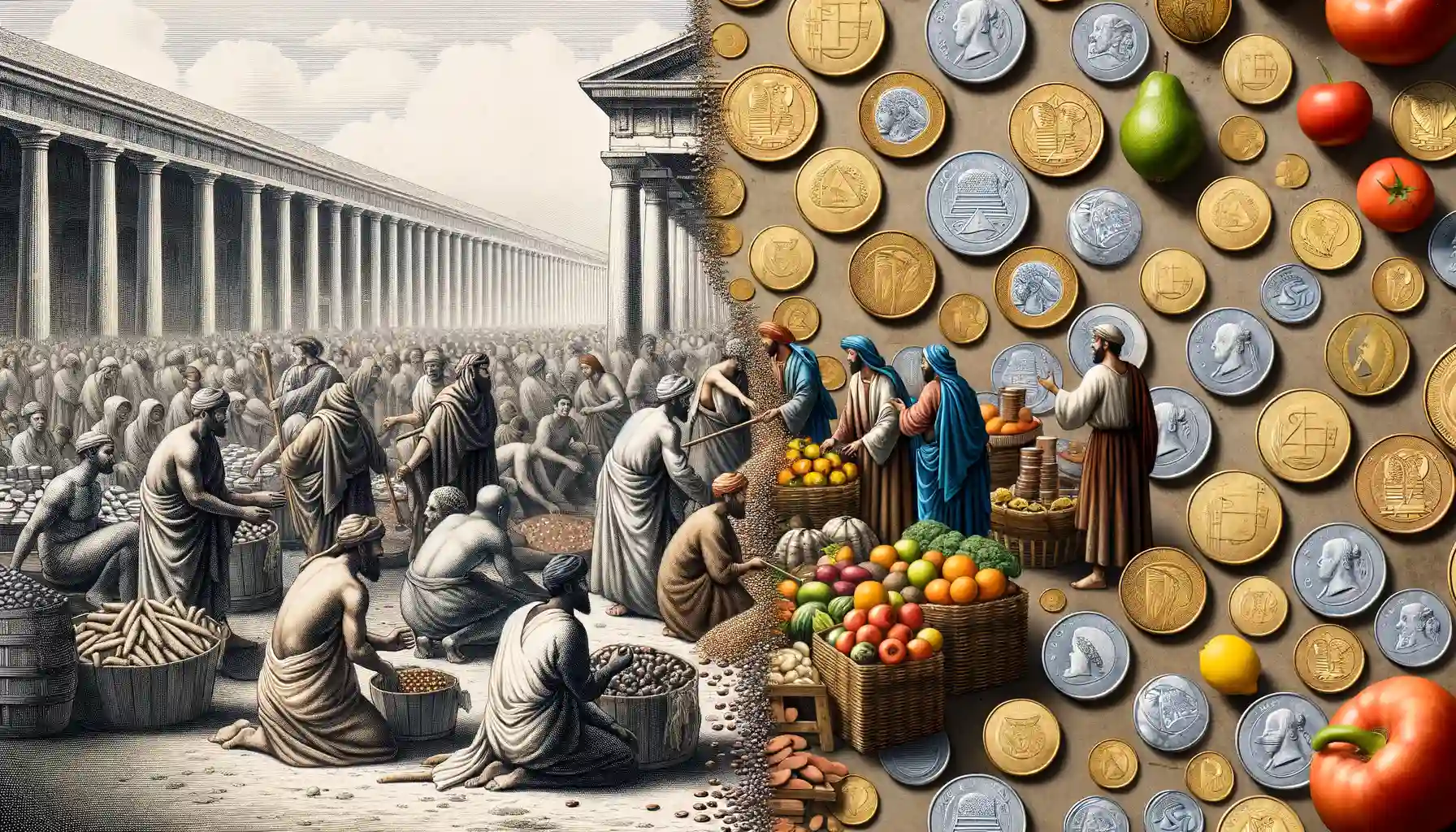

Imagine living thousands of years ago, with no wallets, no banks, and definitely no credit cards. Back then, everything revolved around bartering—a trade of goods for goods. You’d exchange your basket of apples for your neighbor’s goat, but what if they didn’t need apples? That’s where things got complicated, fast! Ancient civilizations quickly realized they needed something more universal, something everyone valued. Enter the fascinating birth of **currency**.

The First “Universal Language” – Coins

Around 600 BCE, the Lydians (modern-day Turkey) created something revolutionary: the **first coins** made of a mix of gold and silver called electrum. These shining little pieces weren’t just practical; they were a status symbol, stamped with symbols of gods or kings. Coins allowed people to calculate value easily, no awkward haggling required!

- Ancient Greeks embraced coins to fuel their vibrant trade networks across the Mediterranean.

- The mighty Roman Empire took it further, minting coins with emperors’ portraits to reinforce their authority.

What’s incredible is how these small, clinking objects became more than a tool—they became part of society’s identity. Coins told the story of who you were, where you came from, and what your civilization valued most.

The Transition from Barter to Coinage Systems

The Spark That Transformed Trade Forever

Imagine this: a farmer with more eggs than he can eat meets a potter desperately needing food but offering only clay pots in return. This was the reality of the barter system—a world where every transaction was an intricate dance of need and coincidence. But what if the farmer didn’t like clay? Or the potter didn’t want eggs? The cracks in the system were all too visible.

Then came a revolution that would rewrite history: the birth of coinage. It wasn’t just an invention; it was humanity’s “Aha!” moment. Picture ancient Lydia (modern-day Turkey) around 600 BCE, where the first **shimmering coins**—tiny discs of electrum (a mix of gold and silver)—were struck. These weren’t just shiny objects; they were symbols of trust and value, transcending individual barter deals.

- Standardized value: Coins introduced a universal measure for trade, eliminating awkward haggling.

- Portability: Carrying a purse of coins was far lighter than dragging a goat to market!

With coinage, economies blossomed, and trade knew no borders. From marketplaces to empires, this small, clinking innovation became the cornerstone of civilization’s progress, whispering tales of its enduring legacy even today.

Paper Money and Its Global Impact

The Birth of a Revolutionary Idea

Picture this: centuries ago, people lugged around heavy sacks of gold and silver just to make a simple purchase. Then came a seemingly magical concept—paper money. It was light as a feather but held the power of a treasure chest. Originating in China during the Tang Dynasty, it spread like wildfire, forever altering how societies exchanged goods. Imagine telling a medieval merchant that a slip of paper could buy them a house!

This innovation wasn’t without skepticism. People asked, “Can a mere piece of paper really hold value?” The answer came through trust—backed by governments and traders who dared to dream of a more efficient system.

A Ripple Effect Across Economies

The introduction of paper currency unleashed waves of global transformation:

- Trade flourished: Lightweight money meant easier transactions across far distances.

- Empires expanded: Nations unified their economies, creating stronger political and economic structures.

- Finance evolved: Banks emerged, issuing notes and fueling a world where credit and loans became mainstream.

From bustling ancient bazaars to modern stock markets, the impact of paper money echoes loudly. But here’s the twist—it’s not just history. Each crumpled bill in your wallet carries the weight of centuries of societal leaps forward.

The Rise of Digital Currency and Cryptocurrencies

From Physical to Virtual: The New Era of Money

Imagine a world where you can send money across the globe in seconds, without banks, borders, or bureaucracy. That’s not a futuristic dream—it’s happening now with the rise of digital currencies and cryptocurrencies. These aren’t just nerdy buzzwords; they’re reshaping how we think about trust, value, and even freedom.

Take Bitcoin, for instance. Born in 2009, it wasn’t taken seriously at first—much like email back in the 90s. Fast forward a few years, and this decentralized currency is now a household name. Why? Because it gave people something revolutionary: ownership and control over their money without middlemen.

But it’s not just tech enthusiasts who are on board. Apps like PayPal and companies like Tesla have embraced this shift, making it clear that cash isn’t king anymore—it’s evolving into code.

Future Trends in the Evolution of Money

How Technology is Reshaping the Way We Exchange Value

Imagine a world where your morning coffee doesn’t just cost you $3—it costs you 0.00013 of a cryptocurrency or gets deducted automatically via a smart contract when you walk out of the café. Sounds futuristic, right? But it’s not as far off as you think.

The future of money is being shaped by groundbreaking technologies, creating shifts that feel like something out of a sci-fi movie. We’re talking about:

- Central Bank Digital Currencies (CBDCs), which could redefine how governments issue and control money.

- The rise of decentralized finance (DeFi), where financial systems run without intermediaries like banks.

- Programmable currencies that allow conditions to be embedded right into the money itself (think about allowances tied to chores!).

Money That Thinks and Moves With Us

Picture this: you forget your wallet at home, but your wearable device seamlessly handles every transaction. From biometric payments scanned by your fingerprints to augmented reality shopping where purchases are made with a blink of an eye—money is becoming more invisible.

And let’s not forget the rise of the metaverse! Virtual economies, powered by tokens and blockchain, are already thriving. Imagine your avatar buying a designer jacket in a virtual world, but—you guessed it—it arrives at your real-world doorstep too. The boundaries between virtual and physical currency use might disappear entirely.

Exciting? Absolutely. A little intimidating? Perhaps. One thing’s for sure: the pace of change is breathtaking.